Minimum Tax Oecd - Global Minimum Tax What Is It How Would It Work For Multinational Companies Bloomberg

The seven countries that have yet to sign onto the Inclusive Frameworks statement endorsing the adoption of a global minimum tax have their reasons for holding off but it is important to highlight that all of the countries remain constructively engaged according to Grace Perez-Navarro Deputy Director of the OECDs Centre for Tax Policy and Administration. To put a floor on tax competition on corporate income tax through the introduction of a global minimum corporate taxthat countries can use to protect their tax bases.

GLOBAL MINIMUM TAX CONFIRMED BUT QUESTIONS GROW OVER OECD COMMITMENT TO INCLUSIVE REFORMS.

Minimum tax oecd. Pillar Two does not eliminate tax competition but it does set multilaterally agreed limitations on itThe twollar packag-pi also e. The OECD pointed out that the move could increase global tax revenues by approximately 150 billion US dollars annually Reuters reported. On 12 October 2020 the OECD released for public consultation updated reports on its two-pillar proposal to address the tax challenges of the digitalisation of the economy.

There might be a leak in the OECDs global minimum tax proposals GLOBE. On 12 October 2020 the OECD released for public consultation updated reports on its two-pillar proposal to address the tax challenges of the digitalisation of the economy. Deal to be finalised by October and take effect in 2023.

Address the Tax Challenges Arising From the Digitalisation of the Economy 1 July 2021 Introduction The OECDG20 Inclusive Framework on Base Erosion and Profit Shifting IF has agreed a two-pillar solution to address the tax challenges arising from the digitalisation of the economy. The OECDG20 Inclusive Framework on BEPS brings together 140 countries and jurisdictions to collaborate on the implementation of the BEPS Package. The proposal is intended to disincentive companies from inverting their structures due to the increase in the corporate tax rate.

The OECD seeks consensus by the end of 2020 on how to ensure all profits of multinational groups are subject to a yet to be determined worldwide minimum level of taxation. OECD Releases Updated Pillar Two Proposal For Global Minimum Effective Taxation. OECD releases updated Pillar Two proposal for global minimum effective taxation.

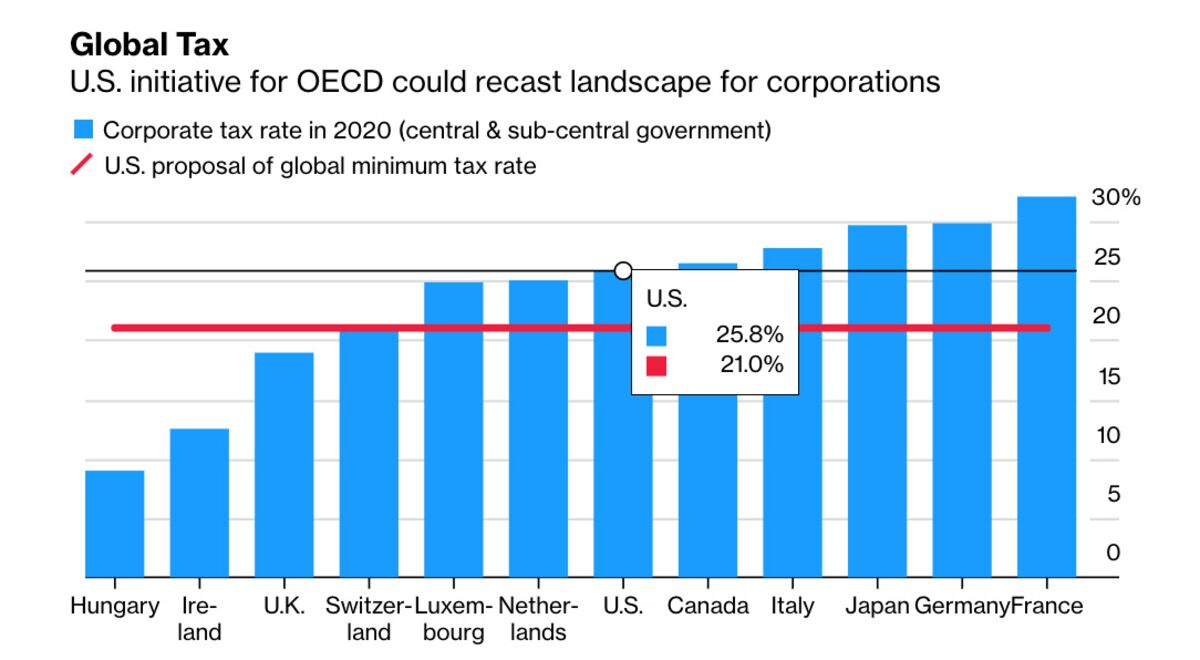

The proposal is similar to Pillar Two except for the rate of the effective minimum tax. While the Organisation for Economic Co-operation and Development OECD was considering a 10-12 rate the G7 agreed to a 15 rate. The timing of moving ahead with US legislative changes is a key issue this fall as tax writers in Congress watch the pace and progress of the OECD negotiations.

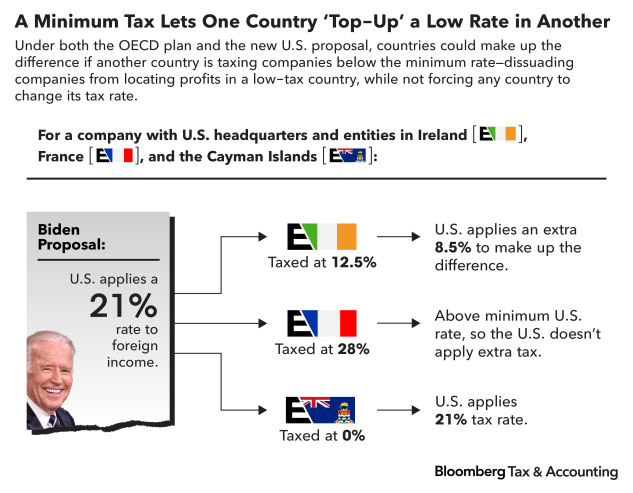

Last year the Organization for Economic Cooperation and Development OECD announced its two-pillar proposal to pursue the goals of transferring tax rights between nations targeting profits of larger companies and multinational corporations and instituting a cross-border minimum tax rate. By Doug Connolly MNE Tax. To address the remaining challenges of base erosion and profit shifting BEPS by large multinational enterprises the OECD envisages a global minimum level of company taxation and top-up taxation by countries up to that level where other countries do not adhere to the new standard.

At a global minimum tax rate of 125 many countries would still be able to introduce some tax incentives without triggering minimum tax concerns. In early summer the Treasury Department issued an update on its negotiationswith members of the OECD which stated the Administrations support for a global minimum tax of at least 15 percent. The Pillar One proposal focuses on new nexus and profit allocation rules for certain.

Promise and Peril for Global Minimum Tax at OECD Negotiations Following last months historic agreement on a 15 percent global minimum tax rate at the G7 Finance Ministers meeting a groundbreaking 130 countries came together to support the Organization for Economic Cooperation and Development OECDs Inclusive Framework in another sign of accelerating progress on global taxation. OECDs plans for global minimum taxation. The Pillar One proposal focuses on new nexus and profit allocation rules for certain.

Brussels Brussels Morning The Organisation for Economic Cooperation and Development OECD announced on Thursday that after two days deliberations 130 countries have expressed support for the proposed 15 minimum global corporate tax rate. However a near doubling in the minimum. OECD Information for journalists 130 countries and jurisdictions have joined a new two-pillar plan to reform international taxation rules and ensure that multinational enterprises pay a fair share of tax wherever they operate.

The BEPS package provides 15 Actions that equip governments with the domestic and international instruments needed to tackle tax avoidanceCountries now have the tools to ensure that profits are taxed where economic activities. However previous discussions at the OECD had focused on a minimum tax rate of between 10 and 15 with a growing coalescence around approximately 125. The proposals if implemented would have a major impact on the way multinationals are taxed and would lead.

We note the statement from the Inclusive Framework and the failure to acknowledge there the many countries that are known to have expressed serious reservations over the deal. 130 economies agree to global minimum tax rate from 2023. In online working-level OECD talks participants vowed to aim for the.

EU members Ireland Hungary and Estonia did not sign deal. A group of 130 nations and regions agreed Thursday to implement a global minimum corporate tax rate and duties on multinational giants in 2023 the Organization for Economic Cooperation and Development said. OECD says 15 minimum tax could boost revenues by 15o bln.

OECD Minimum Tax Rate Hurts the US.

The Push For A Higher Worldwide Minimum Tax Rate Explained

Minimum Effective Tax Rate On Global Multinational Profits Vox Cepr Policy Portal

The Push For A Higher Worldwide Minimum Tax Rate Explained

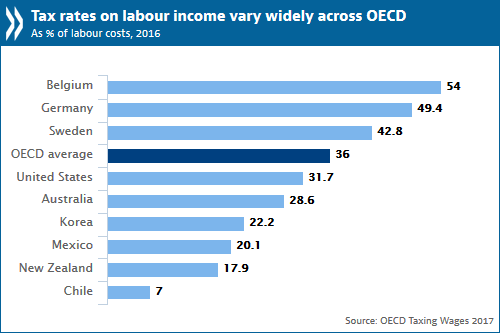

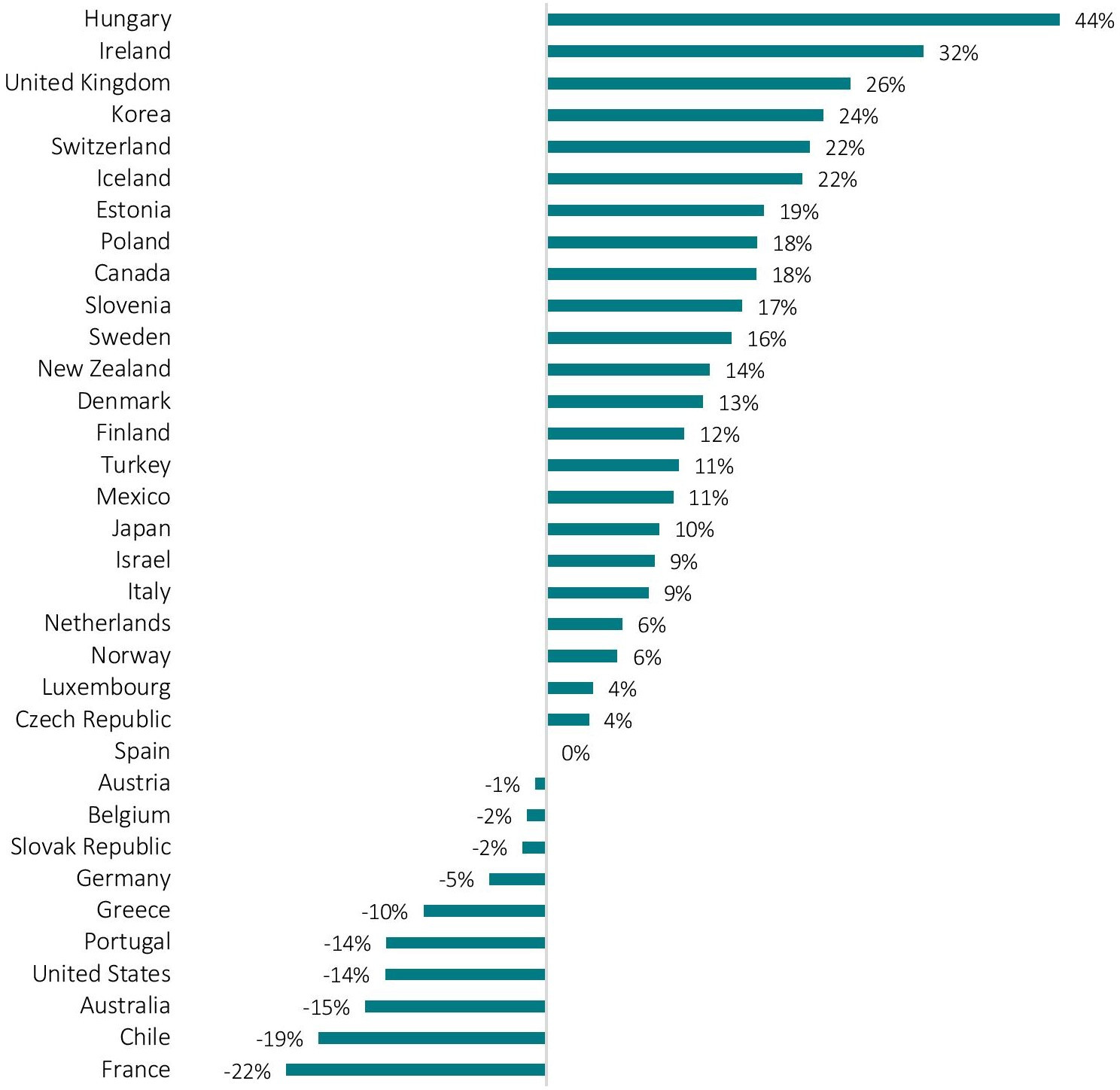

Oecd Tax Rates On Labour Income Continued Decreasing Slowly In 2016 Oecd

Taxes On Minimum Wage In Oecd Countries Europe

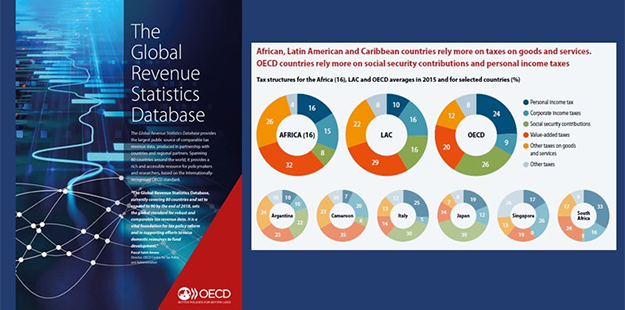

Social Security Contributions And Consumption Taxes Give Way To Personal Income Taxes As Corporate Income Taxes Fail To Recover Oecd

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Global Tax Gains Momentum With Dutch Minister Seeing Summer Deal Bloomberg

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg)

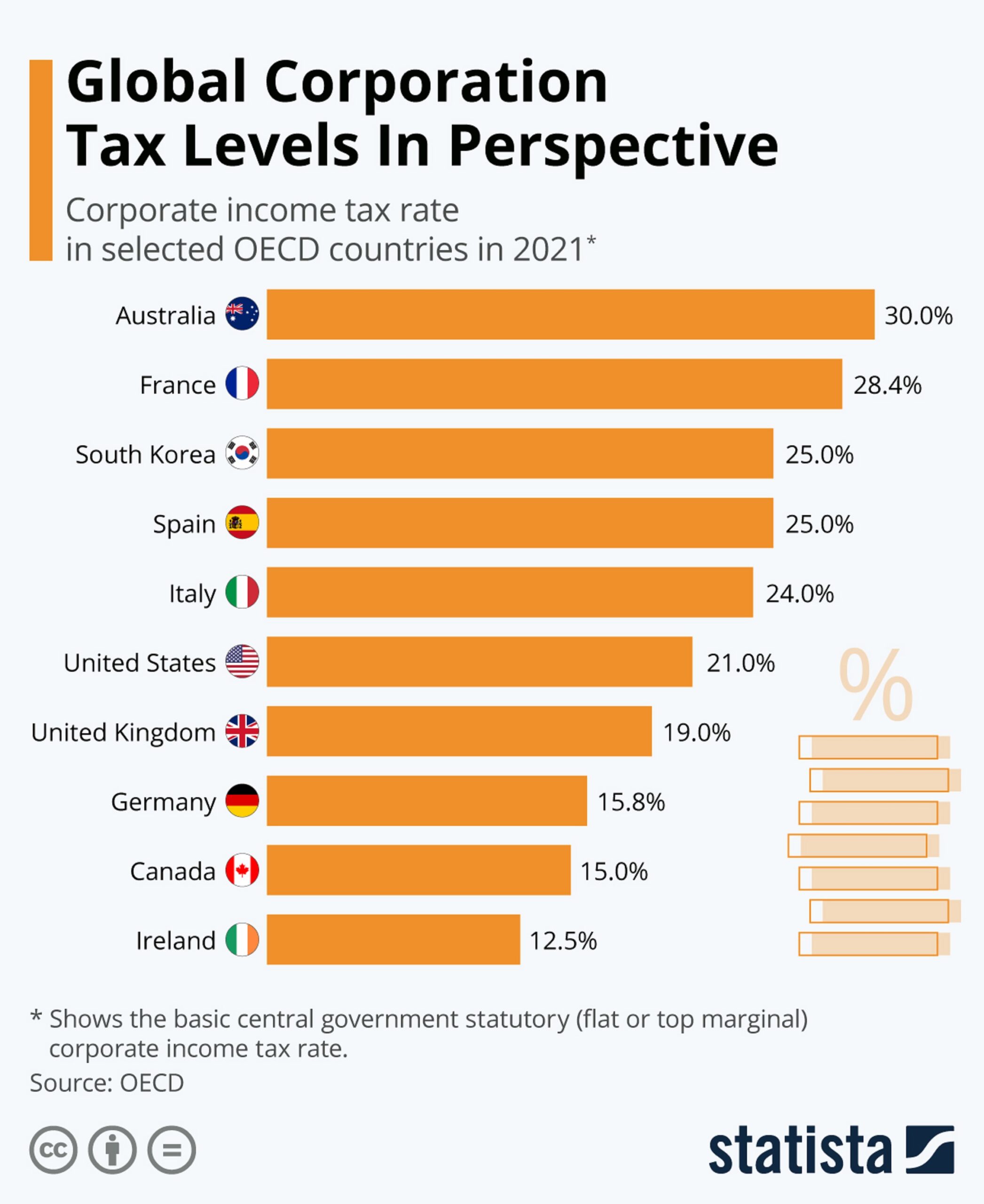

Countries With The Highest Lowest Corporate Tax Rates

Explainer What Is A Global Minimum Tax And What Will It Mean World Economic Magazine

Global Minimum Tax What Is It How Would It Work For Multinational Companies Bloomberg

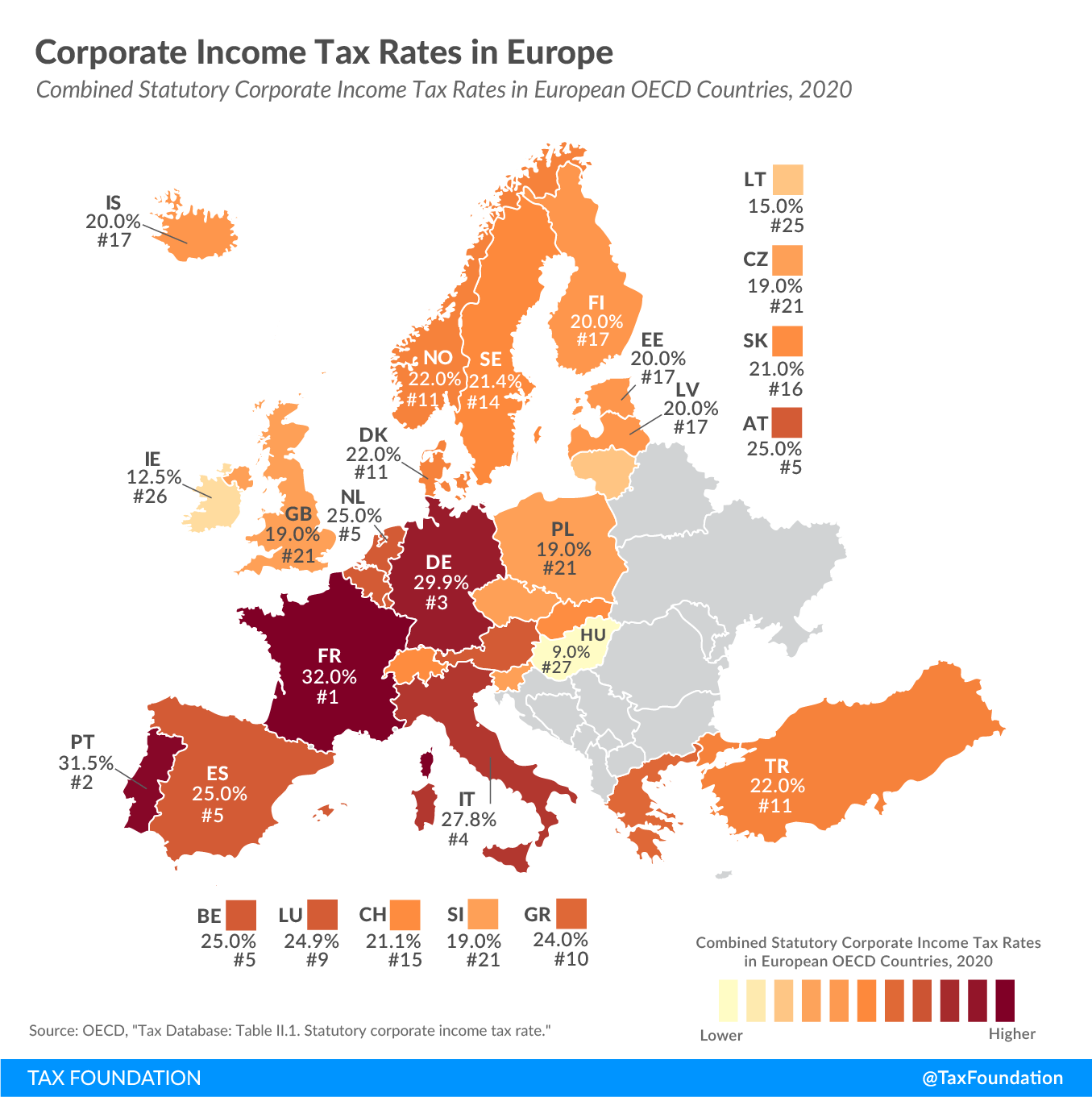

2020 Corporate Income Tax Rates In Europe Tax Foundation

Global Minimum Tax 130 Countries Support Us Backed Measure Oecd Says News Concerns

Cyprus Cannot A œblocka The Minimum Tax Proposal Oecd Model Expected Anaheim Econo Lodge

130 Countries Back Global Minimum Corporate Tax Of 15 World Economic Forum

Oecd 130 Countries Agree On Minimum Global Corporate Tax Rate Euronews

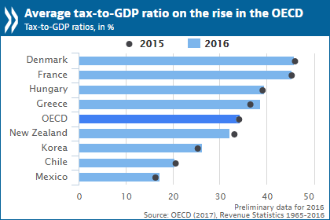

Personal Income Tax Has Risen In The Past Three Years In The Oecd Tax Foundation