Minimum Tax Threshold, How Did The Tcja Change The Amt Tax Policy Center

3 It kicks in at just 98950 for married separate filers. 556 Alternative Minimum Tax.

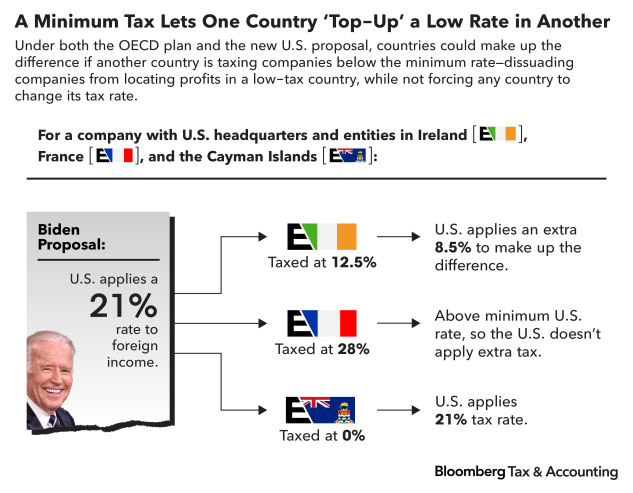

Global Minimum Tax What Is It How Would It Work For Multinational Companies Bloomberg

The amount you earn.

Minimum tax threshold. The 26 AMT tax bracket ends and the 28 AMT tax bracket begins at AMT incomes of 197900 in the 2020 tax year for all taxpayers except those who are married and file separate returns. The alternative minimum tax AMT applies to taxpayers with high economic income by setting a limit on those benefits. For help with your withholding you may use the Tax Withholding Estimator.

For the 2021 year of assessment 1 March 2020 28 February 2021 R83 100 if. Provided however that for a taxpayer that is a member of an affiliated or controlled group as per sections 1504 or 1563 of the Internal Revenue Code of 1986 which has a total payroll of 5000000 or more for the return period the minimum tax shall be 2000. 10 12 22 24 32 35.

Here is a list of our partners and heres how we make money. The information you give your employer on Form W4. Specifically if your income exceeds the annual phaseout threshold set by the IRS your exemption is reduced by 1 for every 4 in alternative minimum taxable income in excess of the applicable.

There are seven federal tax brackets for the 2020 tax year. The amount of income tax your employer withholds from your regular pay depends on two things. Under the tax law certain tax benefits can significantly reduce a taxpayers regular tax amount.

For taxpayers aged 75 years and older this threshold is R151 100. 9 rows The AMT exemptions are phased out by 25 of the excess of alternative minimum taxable income. If you are 65 years of age to below 75 years the tax threshold ie.

The amount above which income tax becomes payable increases to R135 150. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

Explainer What Is A Global Minimum Tax And What Will It Mean Reuters

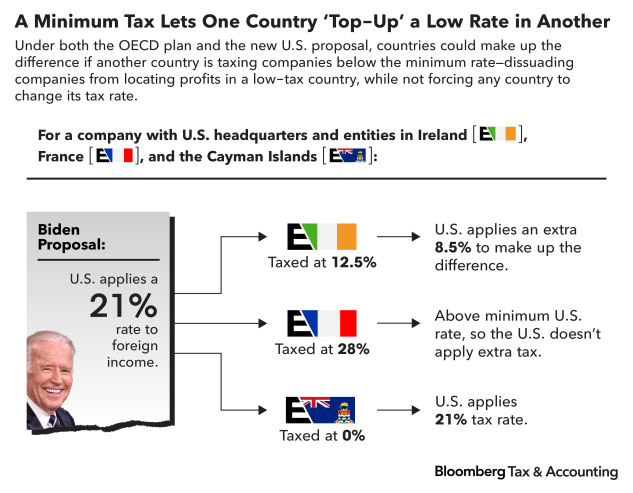

The Benefits Of Setting A Lower Limit On Corporate Taxation Imf Blog

The Push For A Higher Worldwide Minimum Tax Rate Explained

What Is The Amt Tax Policy Center

A Global Minimum Tax And Cross Border Investment Risks Solutions

Alternative Minimum Tax Wikipedia

How Did The Tcja Change The Amt Tax Policy Center

The Push For A Higher Worldwide Minimum Tax Rate Explained

Minimum Effective Tax Rate On Global Multinational Profits Vox Cepr Policy Portal

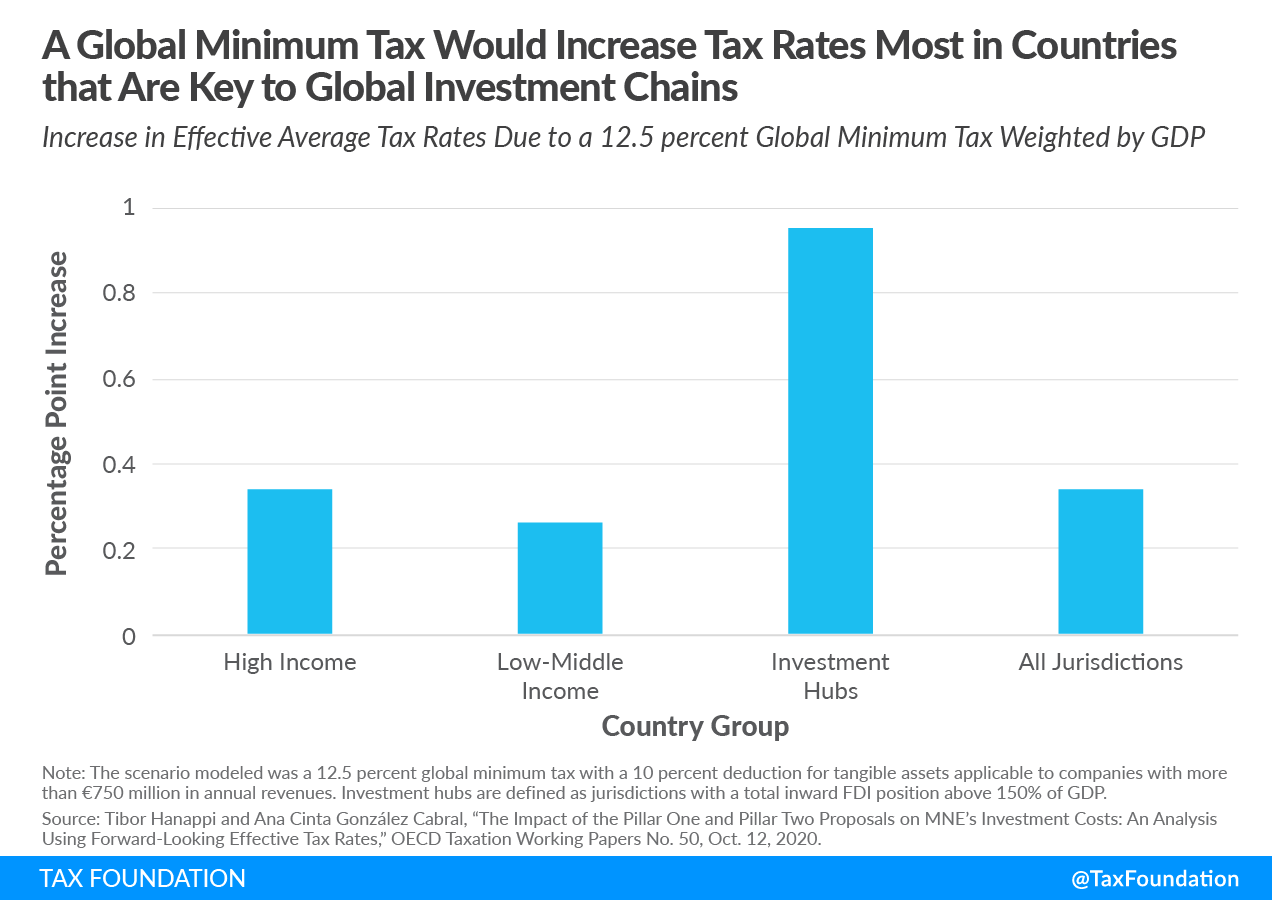

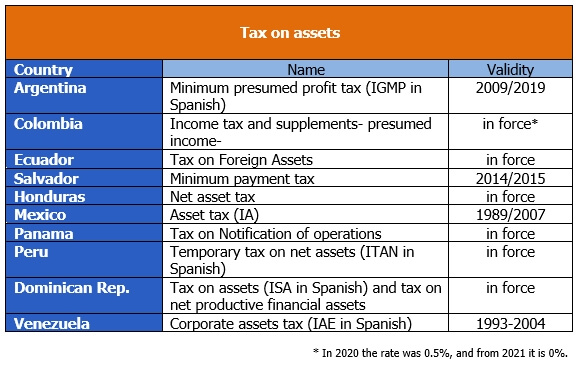

Income Tax Minimum Tax Inter American Center Of Tax Administrations

Alternative Minimum Tax Amt Overview How To Calculate Example

Income Tax Minimum Tax Inter American Center Of Tax Administrations

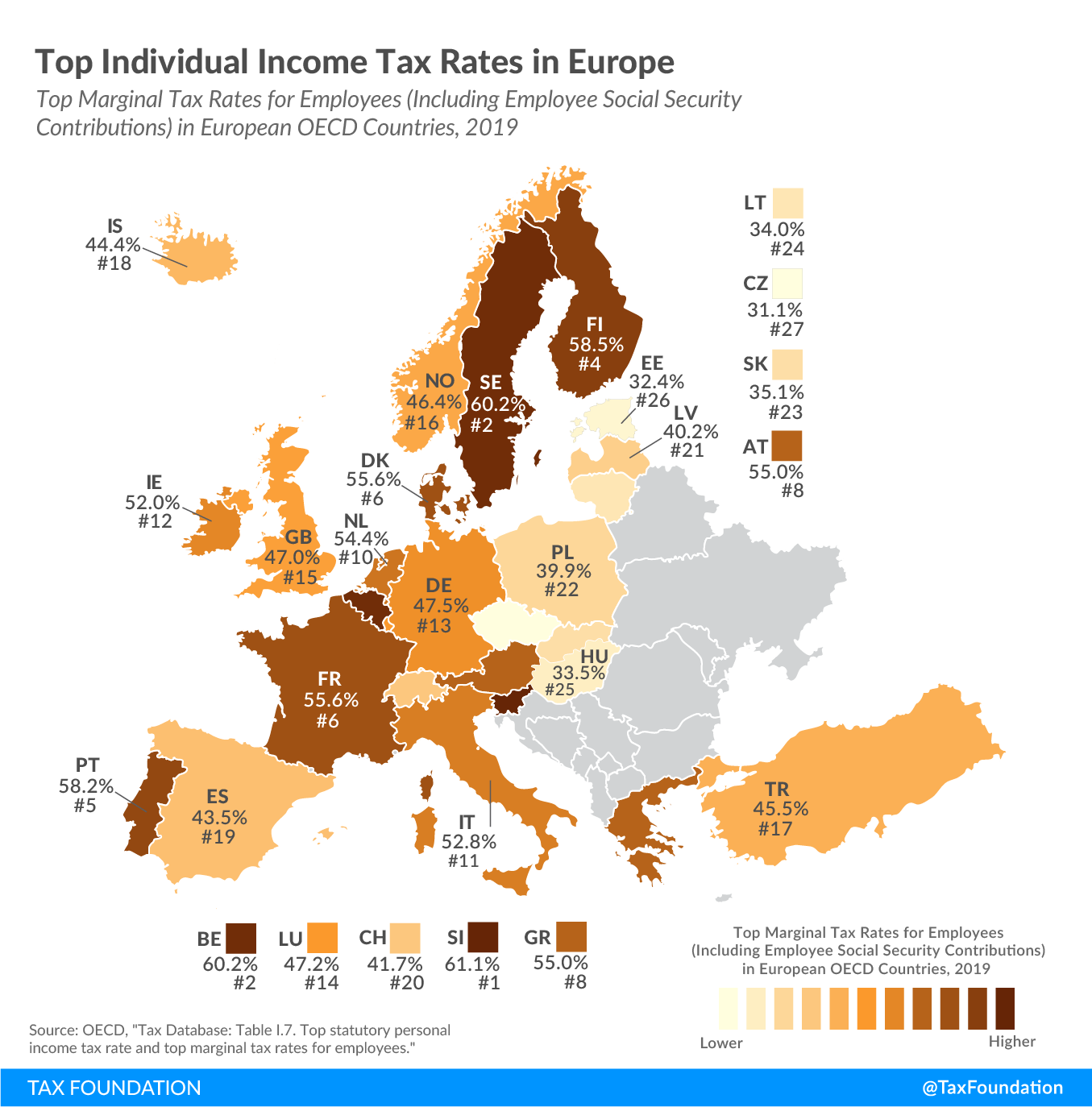

Top Individual Income Tax Rates In Europe Tax Foundation

Top Individual Income Tax Rates In Europe Tax Foundation

Alex Cobham V Twitter Oecdtax Ga4tj And Of Course Our Own Impact Assessment Taxjusticenet Icrict From October Https T Co 3bbtnwegie Twitter

Minimum Corporate Tax Rate Wikipedia

Global Minimum Tax An Easy Fix International Tax Review

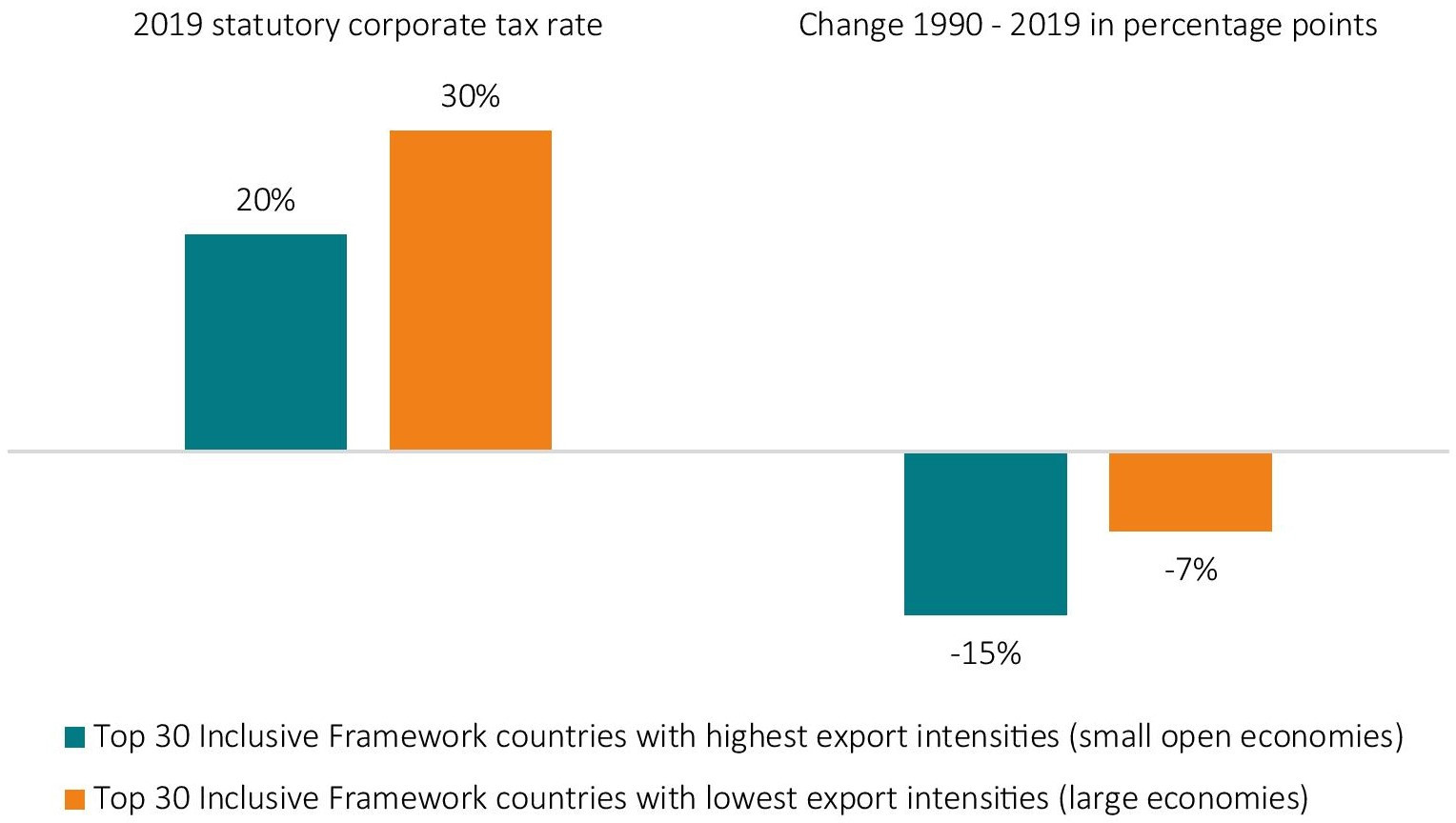

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies